To put it simply, most of us dream of waterfront property, but just not under these circumstances...

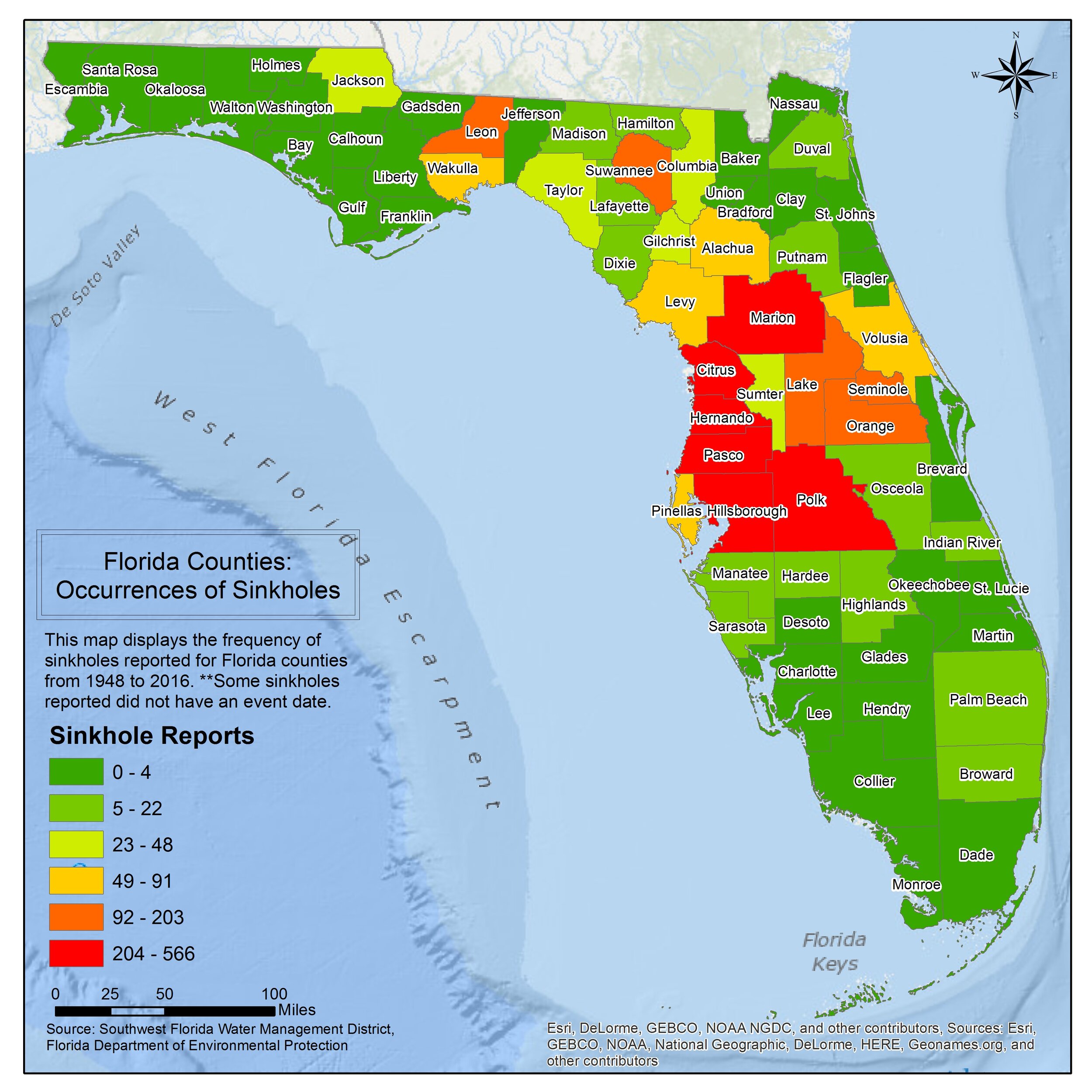

While Florida is best known for its beautiful beaches and sunshine, it is also teeming with underground caves, porous rock layers, and large lakes - creating the perfect conditions for sinkholes to form throughout the state.

While sinkholes are formed in different ways, they can occur slowly or abruptly open up. Since Florida faces many more sinkholes than any other state, legislation has required Florida’s insurers to provide special endorsements and policies that specifically cover sinkholes.

Learn more about sinkholes, and whether you are covered by your homeowner’s insurance from the insurance adjuster pros at Liberty Adjusters…

Are Sinkholes Covered by Homeowners Insurance in Florida?

Although insurers in Florida are required to provide homeowners insurance policies that provide protection from “catastrophic ground cover collapse” that does not mean that your standard homeowner’s insurance policy with cover any damage from sinkholes.

For a sinkhole to be covered under standard homeowner’s insurance in Florida, you must meet these four very strict criteria:

The top layer of soil must sink abruptly

Depression in the ground must be visible

Your home must have structural or foundational damages

A government agency must condemn or evacuate the property

Damage as a result of a sinkhole that does not meet the above criteria will not be covered unless you purchased sinkhole coverage from an insurer separately. In order to meet these criteria, a sinkhole must occur under your home, or at the very least, a portion of your home. Sounds scary right?

Since sinkholes tend to start small and gradually increase in size over time, a standard homeowner’s insurance policy in Florida generally does not cover them. Plus, settling or cracking of your home’s structure does not automatically mean that you will be covered for catastrophic ground cover collapse.

A caveat: Florida insurers like Citizens, People’s Trust, and Universal Property & Casualty must provide policyholders in Florida with an option to purchase sinkhole insurance coverage as either an add-on to their current policy or as a separate policy. This additional sinkhole insurance will provide coverage for the structure of your home and personal belongings if they are damaged by a sinkhole.

Because of the unpredictable nature of sinkholes, sinkhole coverage is somewhat of a grey area, so it is best to speak with your homeowner’s insurer to ensure that your home is adequately covered.

Catastrophic Ground Cover Collapse Insurance

Currently, you can choose to select comprehensive sinkhole coverage or just catastrophic ground cover collapse insurance. What’s the difference? This is important: although catastrophic ground cover collapse coverage might reduce your premium payment and save money each month, it will only apply when your house is condemned following major damage from a sinkhole. Minor foundation and drywall cracks—which could cause future issues—would NOT be covered. But they would be covered under the comprehensive sinkhole coverage policy.

Before choosing an add-on or a separate policy for sinkhole coverage, make sure to think through the possible ramifications of not having proper coverage in the event of sinkhole damage.

Do I Have to Use the Insurance Payout to Fix My Home?

In the event of a catastrophic ground cover collapse (a sinkhole) and you place a claim and receive money from your insurance company, Florida now requires you to use the money to fix the damage to your home that resulted from the collapse.

This rule came to be because there were some homeowners who suffered sinkhole damage, and were paid by their insurance company, but never fixed the damage to their homes. Instead, they sold their properties for 50-60 cents on the dollar, causing the communities where they lived to suffer.

Need help with your sinkhole claim and getting the insurance payout that you deserve? Submit your claim today or call us at 813-922-5129 to speak with one of our expert public adjusters!

What Should I Do if I Need Help Recovering Insurance Payouts for Sinkhole Repair?

While sinkholes are not unique to Florida, more sinkholes develop here than in any other state. It is important to consider adding or renewing sinkhole coverage on a regular basis to ensure that you are covered.

If you have had a sinkhole claim denied, or are having a hard time receiving the insurance payout that you deserve, Liberty Adjusters can help! We can help guide you through the claim appeals process, and fight for the money that you deserve to fix your home.

Further Reading: Why You May Regret NOT Hiring a Public Adjuster

Repair Sinkhole Damage with Liberty Adjusters

Sinkhole claims can be tricky, but Liberty Adjusters is here to help you navigate through the claims process with your insurer. We have helped many homeowners in Tampa Bay like you recover full and fair settlement offers.

If you don’t know where to begin with your sinkhole claim, or if your claim was denied, call our public adjusters today. We will review your claim and help you get the settlement that you deserve to fix your home. We represent homeowners throughout the area, including Tampa, St. Pete, and Clearwater. Submit your claim today!